washington state capital gains tax calculator

Capital gains tax only applies to the profits earned from the sale of a capital asset such as a stock investment real estate or a collectible item. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022.

What Is Capital Gains Tax And When Are You Exempt Thestreet

After federal capital gains taxes are reported through IRS Form 1040 state taxes may also be applicable.

. This tax only applies to individuals. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021. Total Capital Gains Tax.

If you make 70000 a year living in the region of Washington USA you will be taxed 8387. Capital gains can be short-term where the asset is sold in 1 year or less or it can be long-term capital gain where the asset is sold after 1 year. Washington state capital gains tax calculator.

The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. This is called your capital gains tax exemptions. Your basis is the purchase price adjusted for improvements depreciation and other adjustment items.

Use this tool to estimate capital gains taxes you may owe after selling an investment property. Think of basis as an adjusted purchase price. Capital assets are personal property you own for investment or personal reasons.

An investor that holds property longer than 1 year will be taxed at the favorable capital gains tax rate. There is a capital gains tax cgt discount of 50 for australian individuals who own an asset for 12 months or more. The flip-side of the states income tax-free status is its high sales taxes.

The 250000 deduction and the 350000 charitable deduction limit get adjusted upwards for inflation starting in 2023. Washington State Sales Tax. Capital Gains Calculator If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation.

Capital Gains Tax Worksheet Tax Basis. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. Apart from federal income tax the capital gains calculator also computes the state tax on capital gains.

Capital Gain Tax Calculator for FY19. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. 1038 Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset.

Short-term gains are taxed as ordinary income. There are short-term capital gains and long-term capital gains and each is taxed at different rates. The CGT imposes a 7 long-term capital gains tax on the voluntary sale or exchange of stocks bonds and other capital assets that were held for more than one year where the profit exceeds 250000 annually.

Canada Capital Gains Tax Calculator 2022 - Real Estate. Otherwise the sales gain is. However you may only pay.

Cryptocurrency Tax Calculator Capital Gains Tax Calculator. Capital Gains Exclusion us 121. Use this tool to calculate applicable capital gain tax on your.

But since cities and counties collect additional sales taxes on top of that rate rates are typically. It may not account for specific scenarios that could affect your tax liability. Washington Income Tax Calculator 2021.

As of 2019 Washington does not impose a capital gains tax. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. The State has appealed the ruling to the Washington Supreme Court.

This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. When calculating your capital gain you must first calculate your basis in the capital asset before subtracting it from the sales proceeds to determine the tax owed. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

We strive to make the calculator perfectly accurate. While the appeal is pending the Department will continue to provide guidance to the public regarding the tax as a. Short-term capital gains are.

Functioning similarly to personal income tax capital gains tax can be imposed by both the federal and state governments. Yearly Federal Tax Calculator 202223. The states base sales tax rate is 65.

The new law will take effect January 1 2022. This capital gains calculator estimates the tax impact of selling yourshow more instructions. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid.

This information relates to a capital. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling. The new tax proceeds are earmarked exclusively for early education and childcare.

The general provisions for the administration of the states excise taxes contained in chapter 8232 RCW. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Capital gains tax only applies to the profits earned from the sale of a capital asset such as a stock investment real estate or a collectible item.

To calculate the capital gains taxed by Washington state he may deduct either the 250000 standard deduction or 350000 of his 1000000 of charitable deductions. The new law will take effect january 1 2022. What You Should Know.

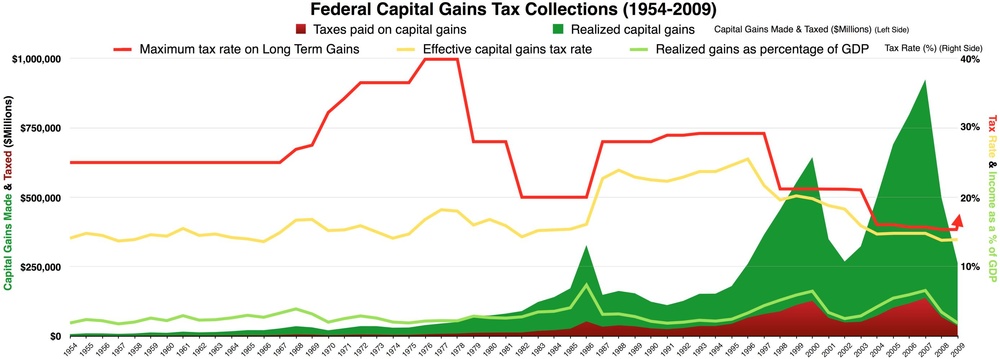

The calculator based on your input calculates both short term capital gains as well as long term capital gains tax. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. Capital gains tax rates have fallen in recent years after peaking in the 1970s.

Capital Gain Tax Calculator 2022 2021

Capital Gains Tax What Is It When Do You Pay It

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How To Calculate Capital Gains Tax H R Block

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Difference Between Income Tax And Capital Gains Tax Difference Between

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

Real Estate Capital Gains Calculator Internal Revenue Code Simplified